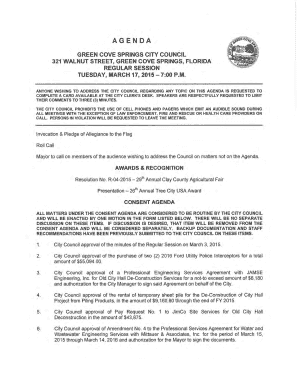

TN RV-F1400301 2013-2026 free printable template

Show details

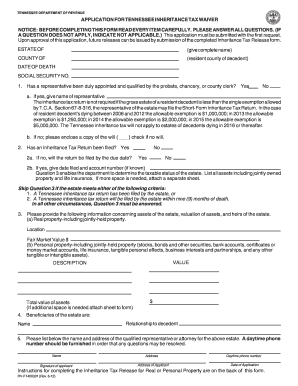

Upon approval of this application future consent forms can be issued by submission of the completed Inheritance Tax Consent to Transfer form. ESTATE OF give complete name COUNTY OF County of TN Probate DATE OF DEATH SOCIAL SECURITY NO. TENNESSEE DEPARTMENT OF REVENUE APPLICATION FOR INHERITANCE TAX CONSENT TO TRANSFER NOTICE BEFORE COMPLETING THIS FORM READ EVERY ITEM CAREFULLY. After completing the consent form keep the pink copy for your records. Mail the original and the yellow copy along...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign tennessee inheritance tax waiver form

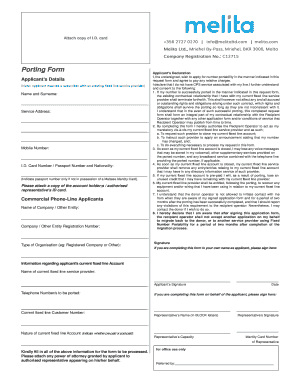

Edit your tax waiver form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your inheritance tax waiver tennessee form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing waiver inheritance form online

Follow the steps below to benefit from a competent PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit does tennessee require an inheritance tenant with rights of survivorship form. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

TN RV-F1400301 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out tn inheritance tax waiver form

How to fill out TN RV-F1400301

01

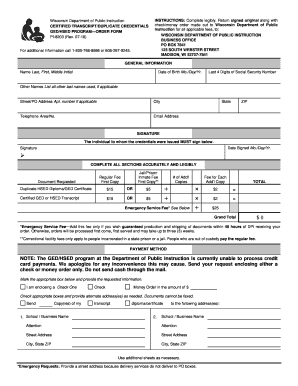

Obtain the TN RV-F1400301 form from the official state website or local office.

02

Fill in your personal information at the top of the form, including your name, address, and contact details.

03

Indicate the purpose for completing the form in the designated section.

04

Provide any necessary identification information, such as your driver's license number or social security number, if applicable.

05

Complete all required fields, ensuring accuracy and legibility.

06

If there are sections that don’t apply to you, indicate that with 'N/A' or leave them blank if instructed.

07

Review the completed form thoroughly for any mistakes or missing information.

08

Sign and date the form at the bottom where indicated.

09

Submit the form according to the instructions provided, either by mail or in person at the specified office.

Who needs TN RV-F1400301?

01

Individuals or businesses in Tennessee seeking to report specific activities or comply with regulations that require the use of form TN RV-F1400301.

02

Taxpayers who need to disclose information for tax purposes or fulfill obligations under Tennessee state law.

Fill

inheritance tax waiver form

: Try Risk Free

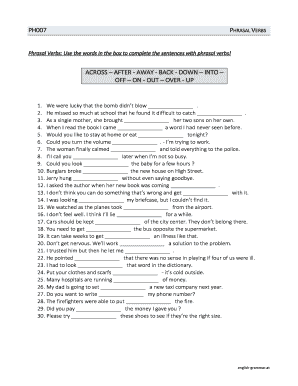

People Also Ask about inheritance tax tennessee

How do I get around inheritance tax?

Set up a trust to avoid inheritance tax If you put assets into a trust, provided certain conditions are met, they no longer belong to you. This means that, when you die, their value normally won't be included when the value of your estate is calculated. Instead, the cash, investments or property belong to the trust.

How much can you inherit without paying federal taxes?

ing to the Internal Revenue Service (IRS), federal estate tax returns are only required for estates with values exceeding $12.06 million in 2022 (rising to $12.92 million in 2023). If the estate passes to the spouse of the deceased person, no estate tax is assessed.318 Taxes for 2022 are paid in 2023.

Do you have to pay federal income tax on inherited money?

Inheritances are not considered income for federal tax purposes, whether you inherit cash, investments or property. However, any subsequent earnings on the inherited assets are taxable, unless it comes from a tax-free source.

Do beneficiaries pay taxes on inherited money?

Generally, beneficiaries do not pay income tax on money or property that they inherit, but there are exceptions for retirement accounts, life insurance proceeds, and savings bond interest. Money inherited from a 401(k), 403(b), or IRA is taxable if that money was tax deductible when it was contributed.

Is there an inheritance tax exemption in Tennessee?

Tennessee Inheritance and Gift Tax Tennessee does not have an inheritance tax either. There is a chance, though, that another state's inheritance tax will apply if you inherit something from someone who lives in that state.

Does Tennessee require an inheritance tax waiver form?

Tennessee Waiver required if decedent was a legal resident of Tennessee. BUT, no tax waiver or consent is required for property passing to the surviving spouse, tenant by entirety or joint tenant with rights of survivorship.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit inheritance tax waiver form tennessee from Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like inheritance tax waiver, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How do I complete in tennessee the executor of the tennessee department of revenue online?

With pdfFiller, you may easily complete and sign inheritance tax tn online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

Can I create an electronic signature for signing my tn form tax waiver in Gmail?

You may quickly make your eSignature using pdfFiller and then eSign your tennessee inheritance tax exemption right from your mailbox using pdfFiller's Gmail add-on. Please keep in mind that in order to preserve your signatures and signed papers, you must first create an account.

What is TN RV-F1400301?

TN RV-F1400301 is a tax form used in the state of Tennessee for reporting certain tax-related information, usually associated with the state's revenue and taxation system.

Who is required to file TN RV-F1400301?

Individuals or businesses that are subject to specific tax obligations in Tennessee are required to file TN RV-F1400301, often including those engaged in certain taxable activities or transactions.

How to fill out TN RV-F1400301?

To fill out TN RV-F1400301, one must provide accurate information about the business or individual, including identification details, tax owed, and applicable deductions or credits, following the instructions provided with the form.

What is the purpose of TN RV-F1400301?

The purpose of TN RV-F1400301 is to facilitate the accurate reporting and assessment of tax liabilities in Tennessee, ensuring compliance with state tax laws.

What information must be reported on TN RV-F1400301?

The information that must be reported on TN RV-F1400301 typically includes taxpayer identification information, details of the taxable transactions, amounts of tax owed, and any applicable exemptions or credits.

Fill out your TN RV-F1400301 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tennessee Inheritance Tax is not the form you're looking for?Search for another form here.

Keywords relevant to is there an inheritance tax in tennessee

Related to tn tax forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.